Nc Food Tax 2025. * some individuals must meet standard gross income limits (130%), and dss will make. A brief history of nc’s “food tax” june 6, 2013 by brian balfour leave a comment.

Beginning in 2025, the rate is reduced to 4.5%, and in 2025, the rate is reduced to 4.25%. There are three eligibility tests for snap:

Belize has a consumption tax known as the general sales tax (gst), which is applicable to all commodities.

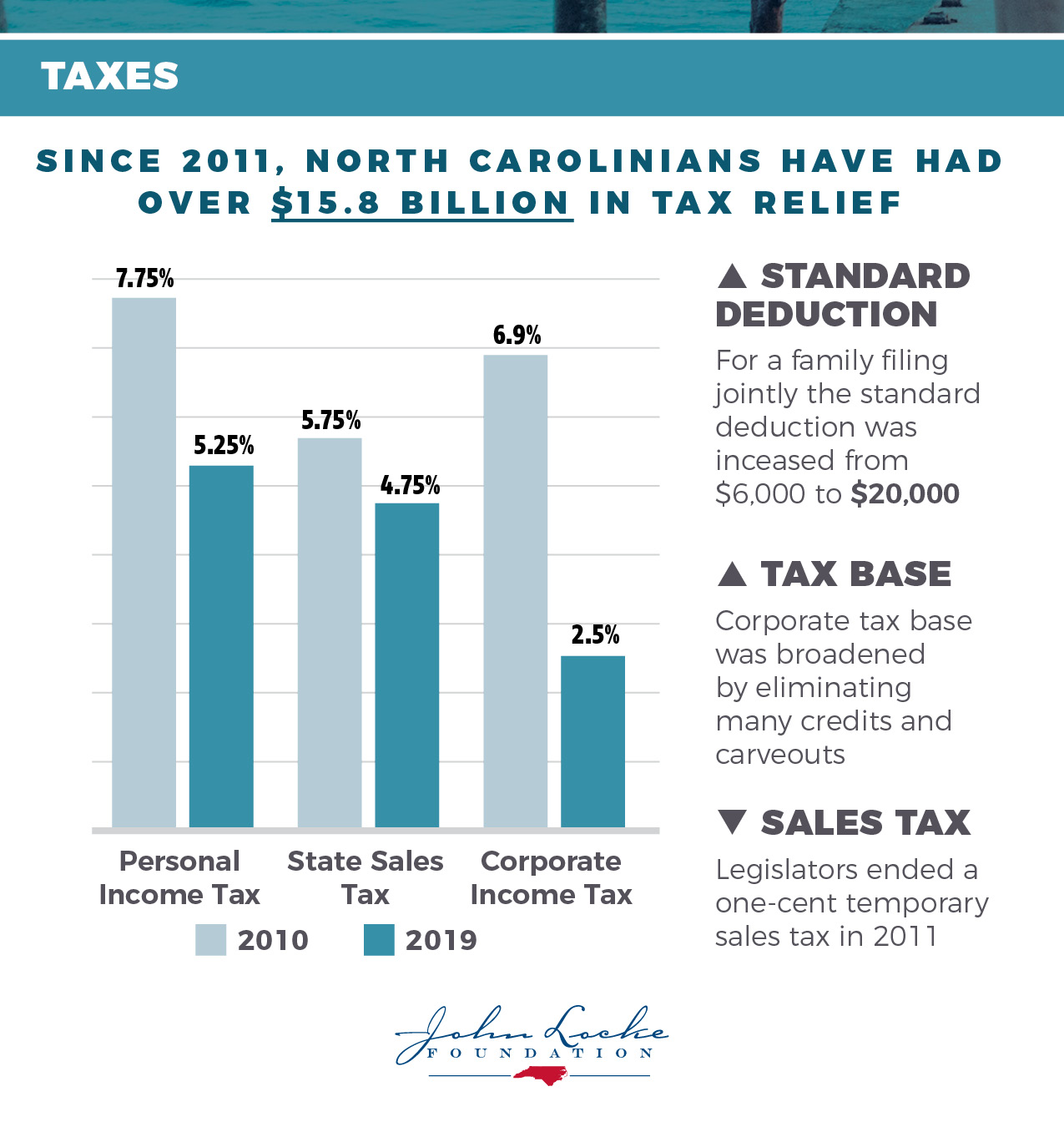

North Carolina At A Glance Taxes, After 2025, the rate becomes 3.99%. Congress to contest ladakh in 2025, 3rd j&k seat.

North Carolina Food Stamp Calculator for 2025 North Carolina Food Stamps, North carolina imposes a general state sales tax of 4.75%. 29, the north carolina department of revenue.

North Carolina Food Stamp Limits for 2025 YouTube, Income tax department will not take coercive action against congress for ₹3,500 crore tax demand during lok sabha elections. North carolina food tax calculator:

The Food Bank of North Carolina APG Advisors, Ncdor opens 2025 individual income tax season. North carolina farmers plant soybeans from the mountains to the coast.

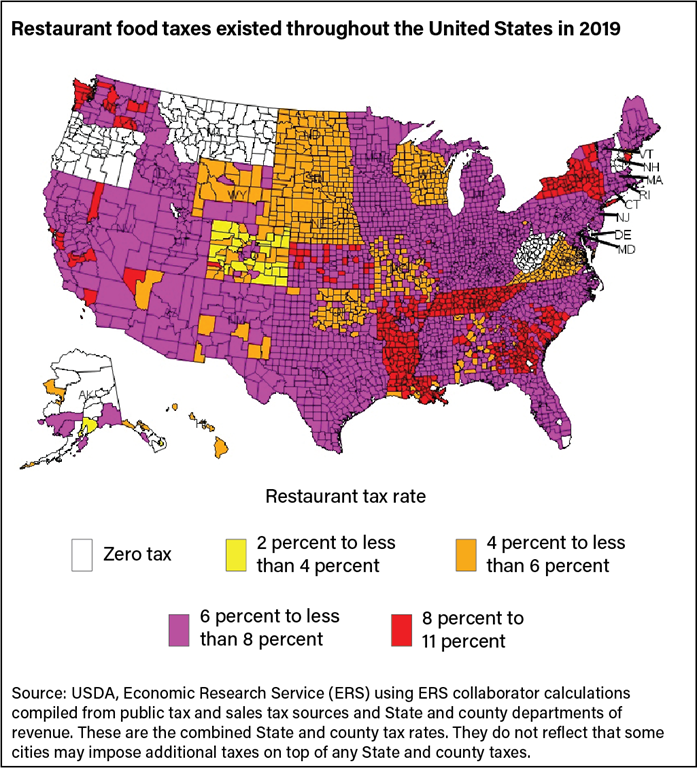

USDA ERS Chart Detail, 30, 2025 snap eligibility in north carolina. Ncdor has recently redesigned its website.

Mastering Your Taxes 2025 W4 Form Explained 2025 AtOnce, Beginning in 2025, the rate is reduced to 4.5%, and in 2025, the rate is reduced to 4.25%. If you want to download a tax form, use the navigation above, search the site, or choose a link.

North carolina estimated tax payments Fill out & sign online DocHub, Congress to contest ladakh in 2025, 3rd j&k seat. The food and beverage tax rate for dare county is 1% of the sales price of prepared foods and beverages sold within the county for consumption on or off a premises by a retailer.

nc sales tax on food items Valencia Staley, The largest impact was seen in the hotel space with about $20 million spent and food and beverage which saw more than $18 million spent. Even if the receipt did not break out each type of applicable tax, you likely paid a minimum of two types of taxes:

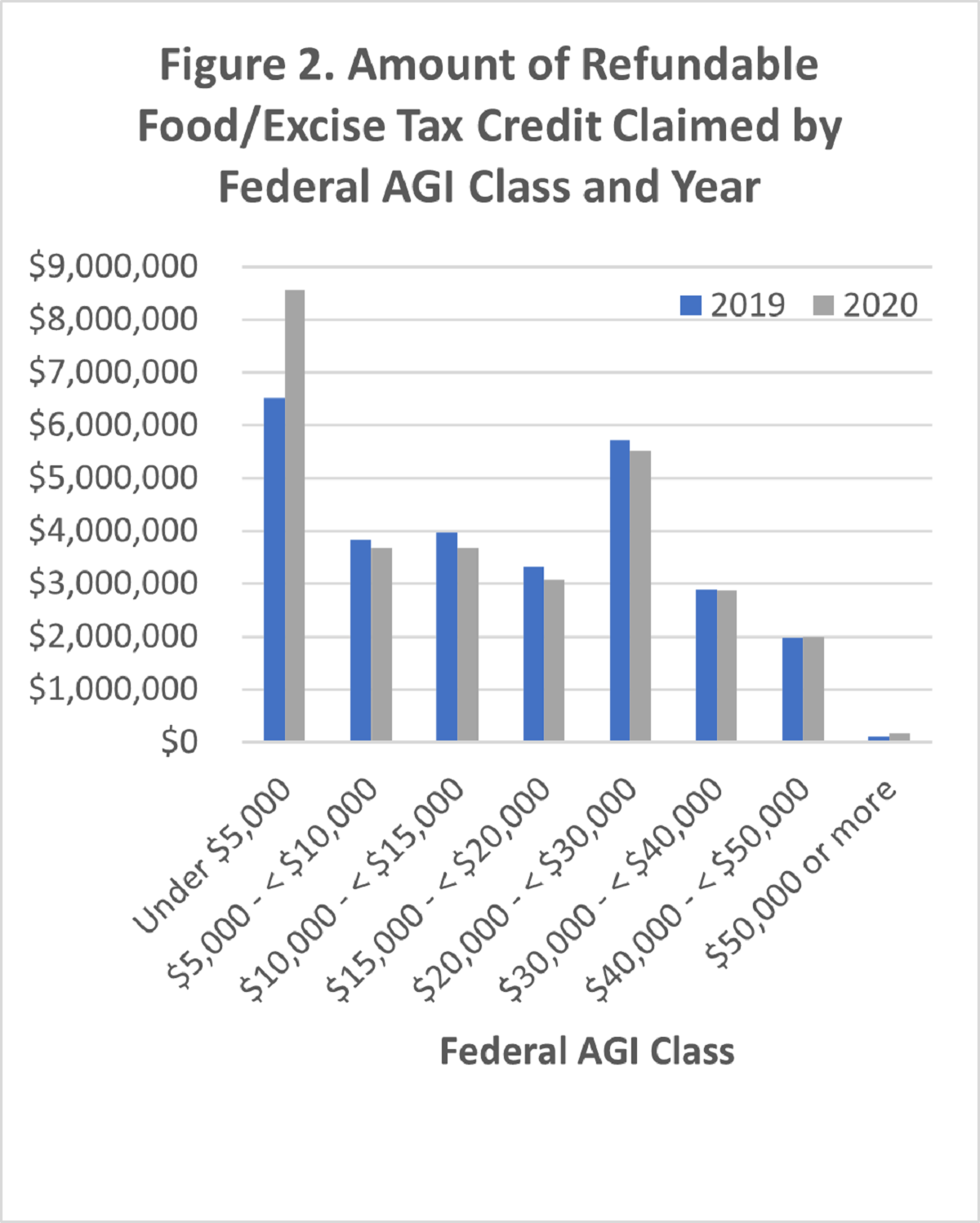

More people claimed the Refundable Food/Excise Tax Credit during the, 30, 2025 snap eligibility in north carolina. 29, the north carolina department of revenue.

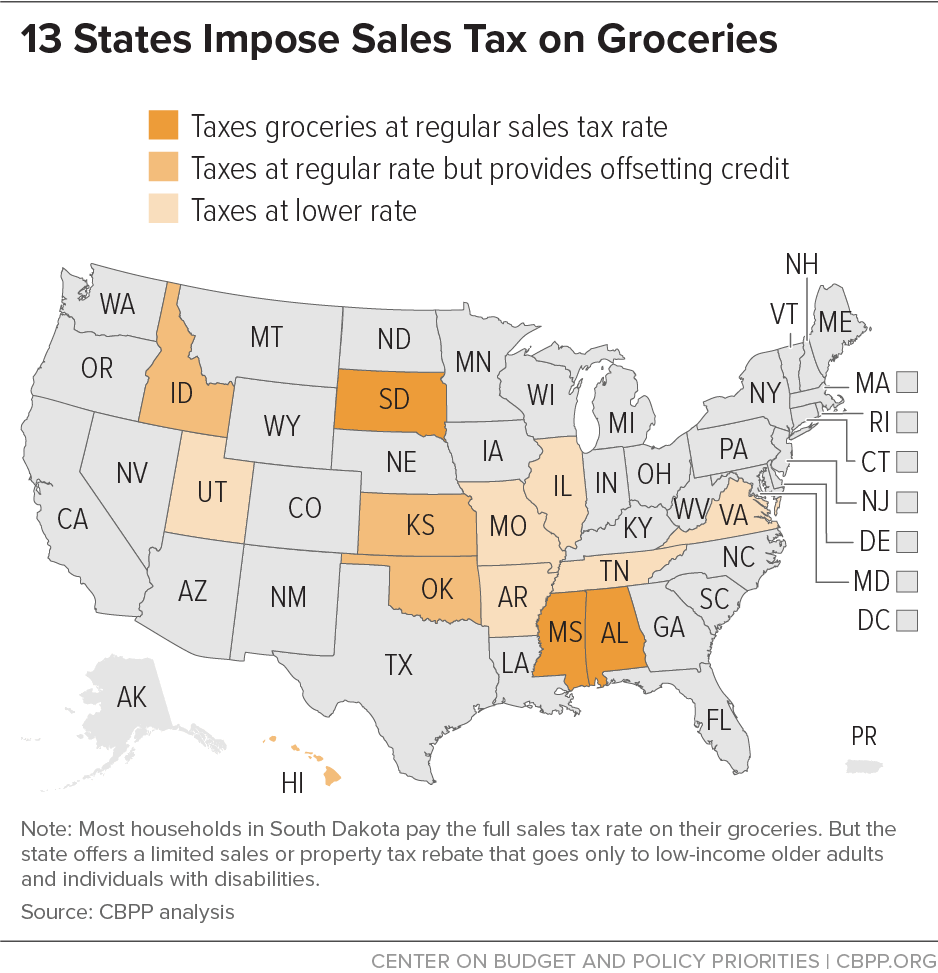

States Can Thoughtfully Implement Grocery Tax Reforms to Help Families, The gross income, the net income, and the asset tests. Before the bipartisan vote, the tax was set to expire in 2031.

The food and beverage tax rate for dare county is 1% of the sales price of prepared foods and beverages sold within the county for consumption on or off a premises by a retailer.